Insurance Company - Analytics Platform

Background

The Company employs over 2,000 employees in its business and provides a range of financial and nonfinancial products to its customers.

Problem

Over the years, The Company has accumulated thousands of self-service (non-governed) and governed Power BI reports, with varying metric definitions, levels of quality, and inconsistent access control patterns.

Internal customers and developers of the reporting platform are complaining about:

- Inconsistent metrics

- Lack of metric re-usability, resulting in duplication

- Poor quality control and inconsistent deployment practices

- Inconsistent report access patterns

- A lack of understanding of Power BI usage across the organisation

- Not easily able to access data sources behind an internal firewall

Solution

Workshops and knowledge base

image is example only

image is example only

- Facilitated 10+ workshops and knowledge transfer sessions to design future ways of working, data governance and self-service strategy.

- Created a SharePoint Site to enable self-service BI users to find documents, policies and guides, training and support resources that were created and agreed in the prior bullet point above.

Power BI Infrastructure and Monitoring

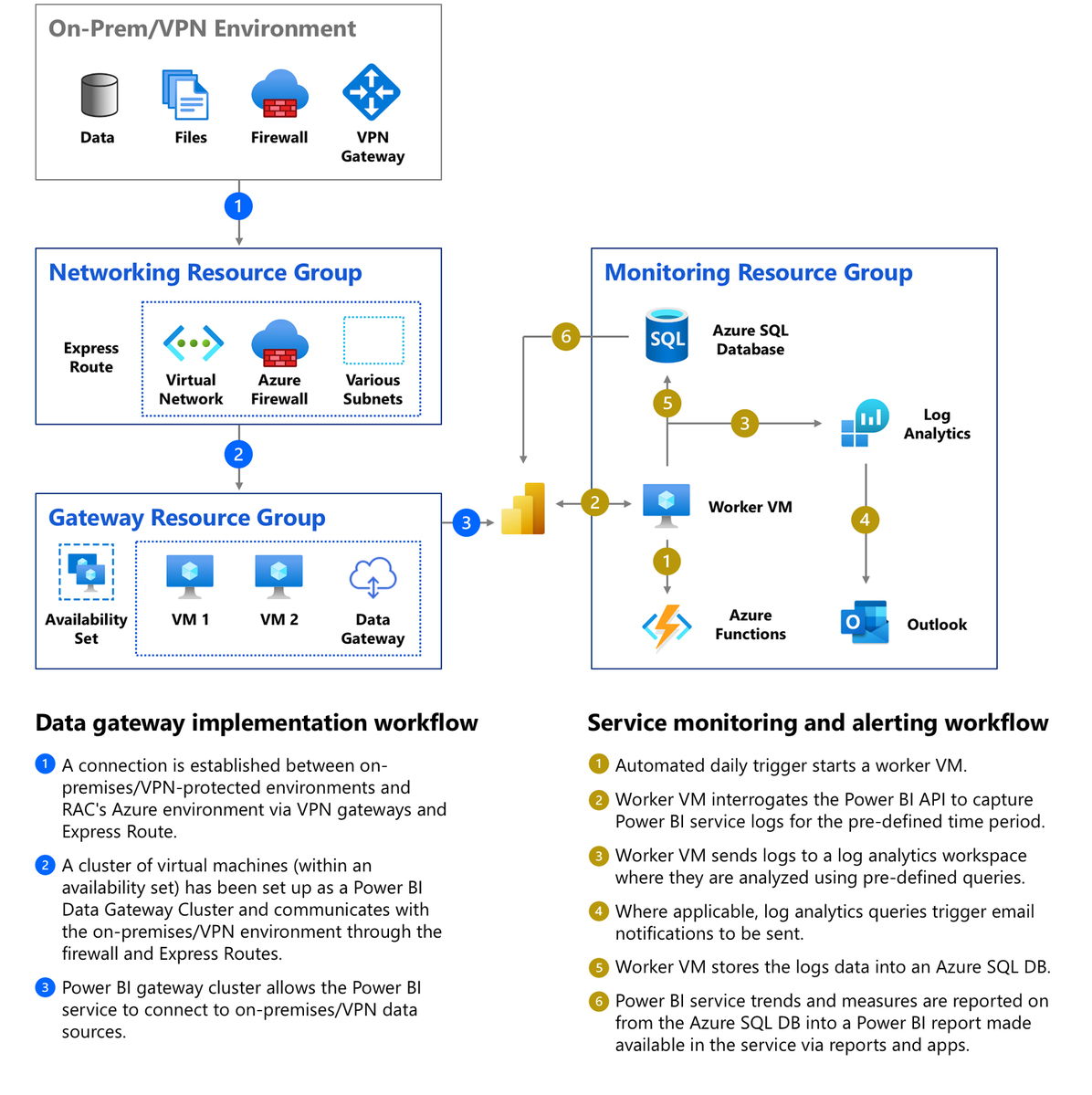

- Implemented a custom-built Power BI Tenant Monitoring Solution utilising Azure Automation Hybrid Workers, PowerShell, Azure SQL Database, Log Analytics and Power BI.

- Deployed Azure Hosted Data Gateway Clusters with connectivity to The Customer’s resources in Azure and On-Premise.

- The code for the infrastructure can be found here: https://github.com/jonathanneo/AzureDataPlatform/tree/main/powerbi/infrastructure/arm

Outcome

- The Customer’s Reporting Platform maturity score improved from 26% to 89% in 5 weeks.

- Governed self-service reporting uptake increased.

- Feedback from Analytics Manager:

“It would’ve taken us 12-18 months to produce the amount of assets that Jonathan did in such a short space of time (5 weeks).”