Blike - Modern Data Platform

Background

Blike provides a cycle-to-work and subscription scheme to lease/purchase e-bikes in the UK.

Problem

- Loan management: business users would like to generate and manage loans and their respective schedules automatically with integration to their payment provider (GoCardless).

- Business reporting: Business users would like to understand operational and financial data.

- Stakeholder reporting: Stakeholders and investors would like to keep track of Blike’s performance by pulling financial and operational data from REST API endpoints.

Solution

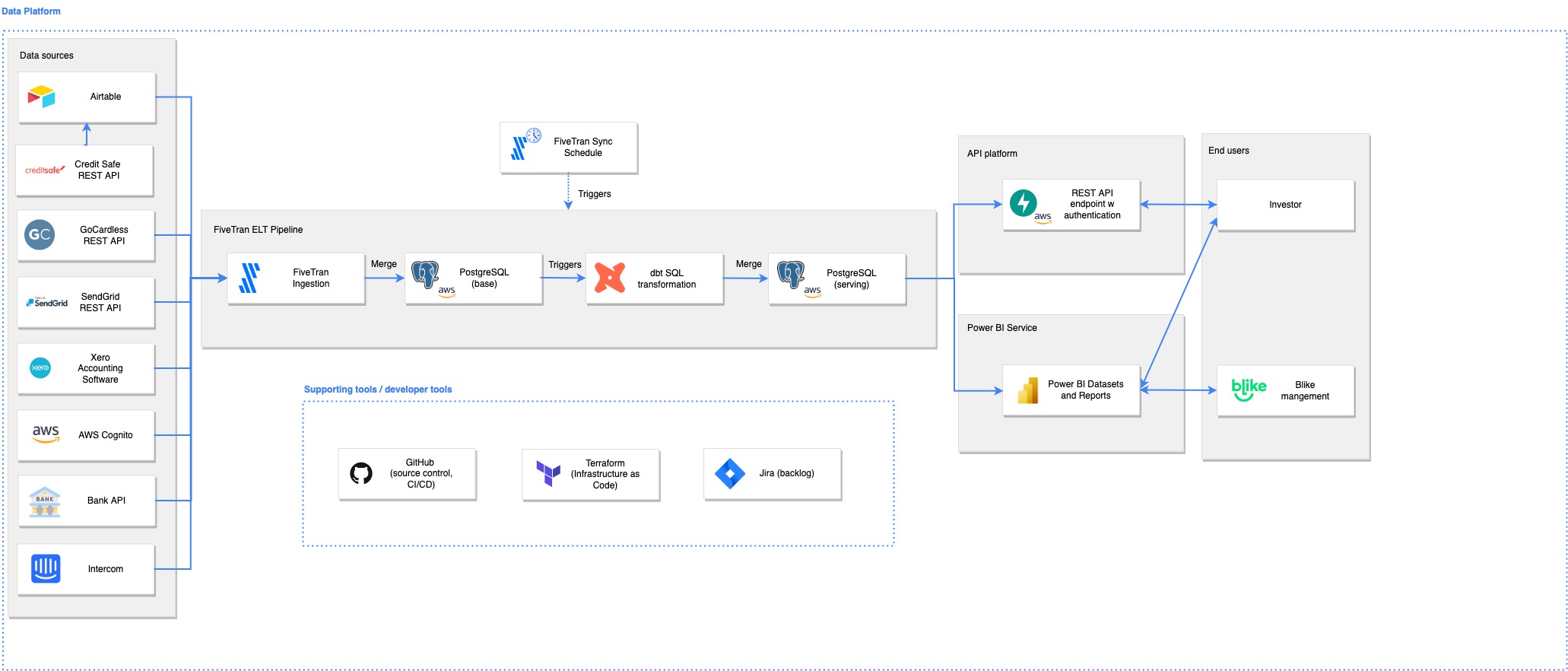

Data platform

- Performed data integration using Fivetran with hourly sync schedules. Where connectors are not supported, I built custom AWS Lambda connectors. Integrated the following sources: Airtable, Credit Safe, GoCardless, Xero, Bank API (cannot disclose our bank), Intercom.

- Landed the data (base tables) into a PostgreSQL database hosted on AWS RDS.

- Performed dbt SQL transformations with snapshotting on base tables. Materialized data into a serving schema. dbt triggered via Fivetran using integrated scheduling.

- Created REST API endpoints using FastAPI with OAuth 2.0 for investor and third party reporting integration. Hosted APIs on AWS Lambda for cost efficiency and serverless compute.

- Created Power BI Reports and App for management and investor reporting.

- GitHub Actions for CI/CD of all infrastructure and application code.

- Terraform for all infrastructure as code and application configuration using the following providers: AWS, Fivetran.

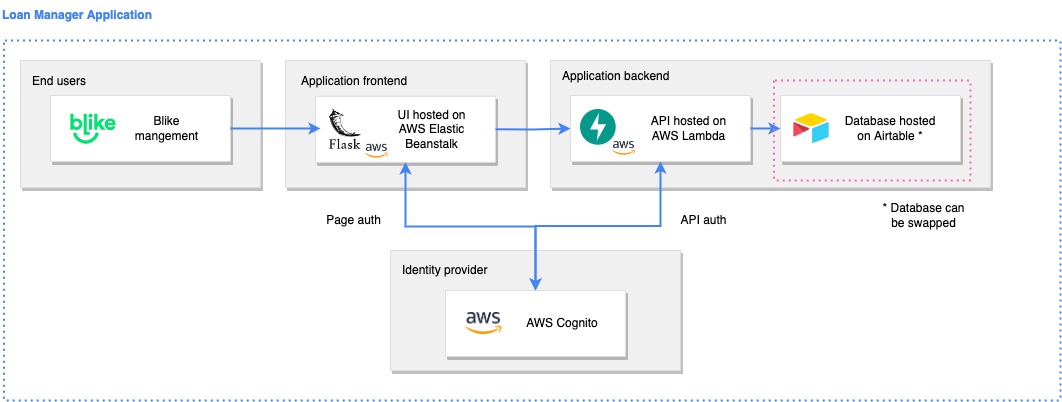

Loan management app

- Built a Python API using FastAPI and OAuth 2.0 which writes data to an Airtable table. Hosted APIs on AWS Lambda for cost efficiency and serverless compute.

- Built a Bootstrap and Flask python frontend user interface for users to generate loan and loan schedules. Hosted UI on AWS Elastic Beanstalk.

- Reconciled payments to loan schedules in real-time using webhooks from GoCardless.

Outcome

- Secured funding from investors as a result of API and Power BI reporting.

- CFO is able to automate generation and reconciliation of loan schedules, payments and bank transaction cash flows.

- Management team is able to understand operational and financial performance of the business.